Knowledge of all different types of companies in USA is important when setting up a viable business in the United States. Each category has its own benefits, legal formations, and taxation conditions. Whether you are flying solo or reaching for incorporation, the correct choice can greatly impact your business’s future. Let’s look at the various types of companies in USA and detail how each can align with your business goals.

İçindekiler

Flying Solo: Sole Proprietorship

A sole proprietorship embodies the very spirit of entrepreneurship-simply, direct, and indivisible as an USA company types. In this business structure, an individual is the sole proprietor, providing them with absolute authority over operations, decisions, and income. This simplicity also applies to setup processes and regulatory requirements, making it an accessible entry point for many would-be entrepreneurs. However, this unincorporated business form still has disadvantages, especially regarding liability. All the owner’s assets—home, car, savings—directly get exposed to any business liabilities or debts.

This risk is exclusive to the sole proprietorship and thus emphasizes the need for comprehensive planning and risk management, which anyone who chooses to go along this way should follow. Nevertheless, for people who want to execute a business idea quickly with as few hurdles as possible, the sole proprietorship provides unmatched straightforwardness and links between the owner’s vision and the enterprise’s daily realities.

Strength in Partnership: General Partnership

Under a general partnership, a business venture can be started with a partner who can multiply the resources and creativity available to the business. Such a structure is a natural progression when two or more people work together to run a business to make a profit. In contrast with the sole proprietorship, the general partnership permits joint decision-making, responsibility, and potentially a wider range of skills to be utilized. All partners contribute to the business, be it in the form of capital, work, property, or expertise, and in return, share in the gains and losses of the business.

This joint ownership implies that liabilities and business results are a joint endeavor- the partnership’s actions are every partner’s assets. Although it promotes teamwork and interdependence, this approach requires trust and communication among partners. The agreement is a significant document in the partnership, detailing each partner’s contribution, share of profits, and duties.

Incorporating Success: Corporations

Other entities like partnerships, trusts, sole traders, and some government arrangements might also be a part of this process. This differentiation is an important function of limited liability protection that protects shareholders’ assets from the company’s debt. C-corporations and S-corporations are two USA corporation types; however, they are designed to meet different business requirements and objectives. In the case of C-corporations, the older form of corporate structure, the tax is levied on the corporate income, with dividends sharing being taxed at the individual level, hence the famous double taxation.

On the other hand, S-corporations are subject to pass-through taxation, where profits and losses are passed to shareholders for reporting on their tax returns, circumventing the double taxation that C-corporations face. Yet, this benefit is accompanied by restrictions such as the number of shareholders and types of shareholders. Choosing to bring the company is a matter of considering all these factors and other factors like the desired investment structures, potential for growth, and the administrative overhead for each structure.

Balancing Risk and Flexibility: Limited Liability Company (LLC)

The LLC (Limited Liability Company), as one of the types of companies in USA, is a contemporary business structure that integrates the liability protection of corporations and the tax benefits and operational flexibility of partnerships. These features combined make LLCs the most preferred structure among entrepreneurs who want security and freedom. LLCs protect personal assets from business debts and claims and allow profits and losses to flow directly to owners, avoiding the double taxation characteristic of conventional corporations. Operational flexibility is one of the major characteristics of an LLC Company.

While companies must have a formal structure of directors and officers, LLCs can be owner-managed (member-managed) or manager-managed by a designated group of managers, which provides versatility suited to different business situations and styles. Moreover, LLCs are free from record-keeping and meeting requirements that are highly demanded of corporations, which makes them less administratively burdensome.

Which Corporation Type to Choose?

Your business objectives primarily determine the corporation types in USA to form, the number of owners, financial systems, and tax issues. C-corporations, as one of the types of companies in USA, provide infinite chances to grow via share selling; however, they are subject to double taxation. S-corporations are free of the double taxation burden, but they have restrictions on ownership and shares. Considering these factors is crucial in selecting the appropriate corporate form.

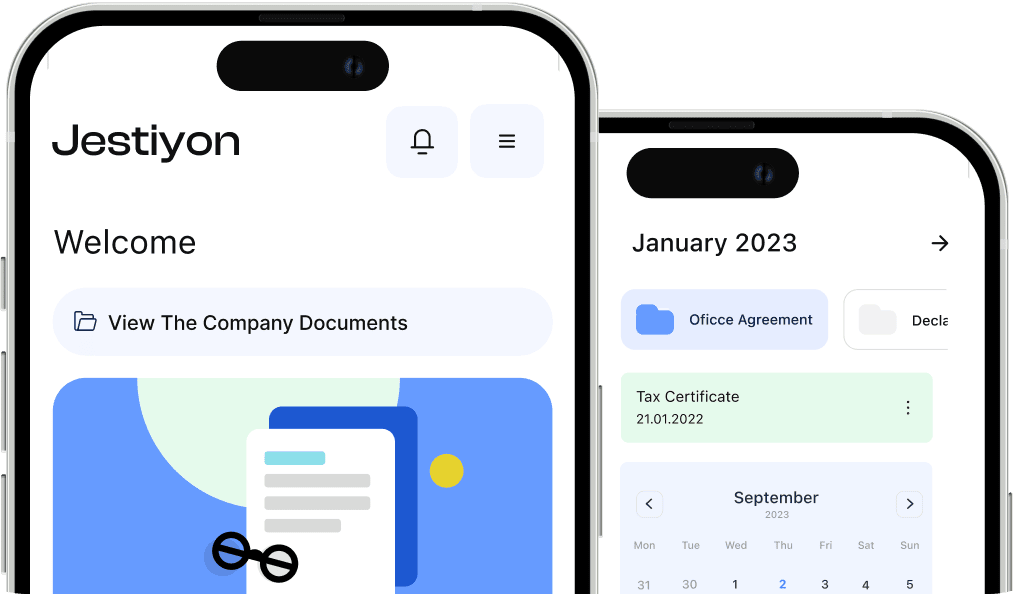

Form Your Company in the USA with the Professional Consulting of Jestiyon

Opting for one of the types of companies in USA is an important choice that can determine the future of your business. At Jestiyon, we know how intricate the process of establishing a company in the USA is. We have developed a professional consultancy service to lead you through the whole process so that your business will comply with all the necessary legal requirements and be set for success. Learn more about our services at Jestiyon and make the first move of building your business in the USA with assurance.