After completing the Jestiyon’s application process for you, our expert finance team will contact you to guide you in the most suitable way based on the characteristics of your business idea and profession. This guidance process is an important step to effectively manage your business establishment. The expert finance team will evaluate your business plan, financial goals, and budget, and provide guidance on the appropriate legal structure, tax regulations, and other steps involved in setting up your business. Additionally, they will make recommendations to optimize your business and assist you in identifying potential opportunities to grow your business.

The Most Curious Questions

Frequently Asked Questions

Jestiyon, your digital solution partner, is always with you for all your inquiries about starting and managing an online company.

Application

About the Process

Which Type of Company Should I Establish?

Which Documents Do I Need to Establish a Company?

- ID Photo

- Business Activities

- If you own the business premises, the Title Deed for the business location

- If the business premises are rented, the Lease Agreement for the business location

- If you conduct your business with a vehicle, the Vehicle Registration

- If the vehicle is owned by you and is brand new, the Vehicle Invoice

- If it’s a second-hand vehicle, the Notarized Sales Agreement

- If it’s rented, the Lease Agreement

All you need to do is upload the above documents as photos to the Jestiyon’s platform.

How Long Does Company Formation Take After Application?

Your registration is obtained on the same day, and we apply for it on the same day after completing the document verification. Once the document verification is completed, we submit your application on the same day. The completion of address identification procedures by the tax office and the creation of your tax registration enables your business to be legally recognized. The tax registration indicates that your business is a taxpayer and complies with all legal requirements.

Taxation

About the System

What are the Advantages of Establishing a Sole Proprietorship?

The advantages of establishing a sole proprietorship include:

- Subject to Income-Proportional Taxation

- Can Be Opened as a Single Person or with a Partner

- Low Establishment Costs and Financial Consultancy Fees

- Lower Capital Requirements

Keep in mind that while sole proprietorships offer these advantages, they also come with disadvantages, such as unlimited personal liability and limitations on raising capital.

What Are the Types of Taxes to be Paid in a Sole Proprietorship?

Taxes paid by sole proprietorship companies may include:

- Income Tax

- Value Added Tax (VAT)

- Withholding Tax

- Geçici vergi

- Temporary Tax

- Stamp Duty

The tax obligations of a sole proprietorship can vary significantly depending on the country and the nature of the business.

How Will I Process My Expenses?

Certainly, the system allows you to efficiently manage your business expenses for the month by offering the following features:

- Expense Receipt Upload

- Convenient Data Entry

- Extended Data Storage

- Quick Report Generation

How Can I Get Support During Tax Calculation and Payment Period?

Once your financial advisor completes the required calculations and processes your declaration through the system, the finalized declaration will be uploaded to the Documents tab. You will receive a notification prompting you to review and approve it. Following your approval, we will provide you with a link to the interactive tax office, enabling you to make payments.

Will I Be Able to Follow My Declarations Regularly Every Month?

In the Documents tab, you can access not only your current period declaration but also view your past period declarations and accrual slips.

Who will make the SGK entries of my employees?

With Jestiyon support, you have the convenience of notifying your financial advisor directly through the system. Whether you need assistance or have specific requests related to your financial affairs, the system allows you to communicate with your advisor efficiently. Additionally, you can manage various personnel processes, including salary payments, through your pre-accounting program.

About the

e-Transformation

Process

What is an e-invoice? Why should I issue e-invoices?

The e-Invoice process and system are cutting-edge applications designed to create invoices electronically, and it operates just like a traditional paper invoice. By implementing e-Invoices, we streamline and expedite your invoicing process, allowing you to effortlessly manage not only you’re invoicing but also all your financial affairs.

How do I start using the e-invoice solution?

Upon acquiring your financial seal or e-Signature, our dedicated team of experts will reach out to you promptly. Jestiyon support team guides you through the process of completing the Revenue Administration application form online, initiating your e-Invoice activation. Collaboratively, we will navigate through the activation procedure, ensuring it is seamlessly executed.Can I issue paper invoices?

Once your transition to e-Invoice is successfully completed, it’s important to note that you will no longer have the option to issue traditional paper invoices. The electronic invoicing system replaces the need for paper invoices, and all your invoicing processes will be conducted digitally.

What is e-SMM? Who can issue it?

The electronic freelance receipt, known as e-SMM, is an electronic invoice specifically designed for freelancers. Freelancers, including professionals such as lawyers, dentists, doctors, financial advisors, and architects, are mandated to issue their freelance receipts electronically, in accordance with the notification published by the Revenue Administration on 19.10.2019. This regulation requires these individuals to transition from traditional paper-based receipts to electronic ones, ensuring greater efficiency and compliance with tax regulations.

Will e-Ledger also be mandatory when I switch to e-Invoice?

In accordance with the legislation, if your business is required to transition to e-Invoice either due to its turnover or the nature of its operations, you are also obligated to switch to e-Ledger on the New Year’s Eve following the date of your e-Invoice transition. This dual transition is typically mandatory for businesses meeting these specific conditions. However, if you voluntarily choose to switch to e-Invoice and do not meet the turnover or operational criteria that necessitate the switch, then e-Ledger compliance is not mandatory.

What is an e-signature/Fiscal Seal?

The e-Signature is associated with an individual and represents their authorization, whereas the financial seal is specific to a company and signifies the company’s commitment and authority in financial matters. It’s important to understand the distinction between these two mechanisms and apply them according to their respective purposes. The Jestiyon support team is here to provide guidance and address any issues related to your e-Invoicing processes and other financial management needs. Don’t hesitate to reach out to Jestiyon support for assistance as you adapt to the new digital invoicing system.

About the

Pre-Accounting

Program

What Benefits Does the Pre-Accounting Program Provide Me?

As you’re well aware, preliminary accounting plays a pivotal role in overseeing and managing an organization’s financial data. It encompasses a wide spectrum of financial transactions conducted within the organization, spanning from the issuance and collection of invoices to tax payments, inventory monitoring, and the intricate task of managing cash flow.

Which Transactions Can I Do in the Pre-Accounting Program?

With our comprehensive pre-accounting program, you gain the capacity to effortlessly oversee an array of essential financial transactions, covering income and expense management, current account administration, stock management, statement tracking, and employee management, among other vital functions. The program is your one-stop solution for a wide spectrum of financial activities, simplifying the complexity of these tasks. And when you encounter questions or need assistance while using the program, our dedicated Jestiyon support team is readily available to provide guidance and resolve any inquiries you may have.

Is There E-Commerce Marketplace Integration?

Our system offers seamless integration with a wide range of marketplaces, including but not limited to Trendyol, Hepsiburada, Amazon, n11.com, Ciceksepeti, AliExpress, Etsy, and many others. This comprehensive integration capability ensures that you can efficiently manage and expand your e-commerce business across multiple platforms, reaching a broader audience and streamlining your operations.

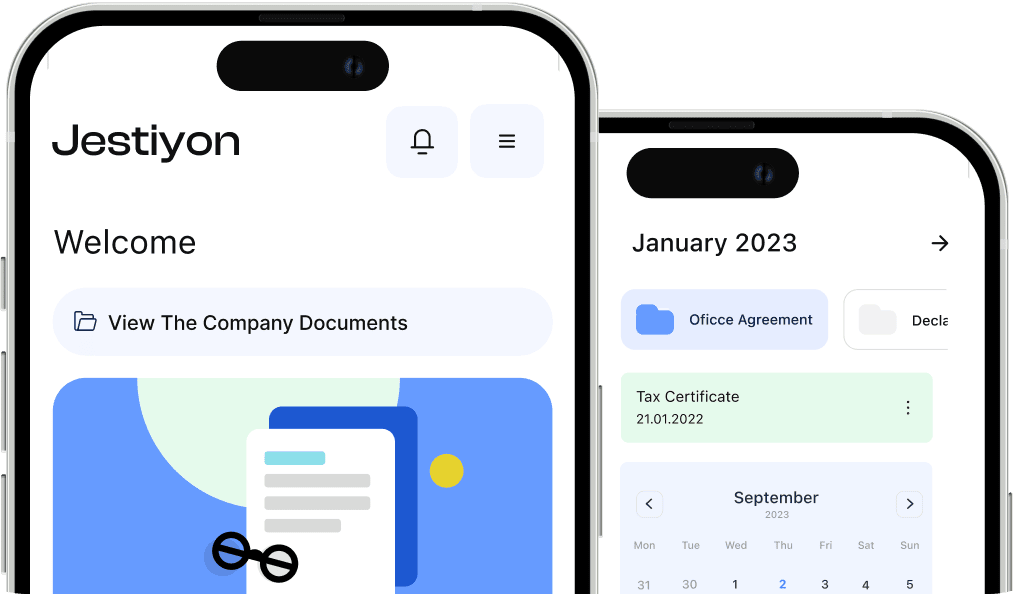

Can I Use Phone/Tablet Compatible?

You have the flexibility to access and utilize our system conveniently by downloading it as a mobile application on your iOS and Android devices.

How Does

Jestiyon Work?

How Do I Subscribe?

To get started, simply click on the registration link provided, and you’ll be directed to a user-friendly interface where you can input your information.

How Do I Trust Jestiyon?

At Jestiyon, we take the privacy and security of our users’ personal data very seriously. We want to assure you that the personal data of our users will be handled strictly in accordance with the privacy policy. Our commitment is to use this data solely for the purposes and within the scope specified in the privacy policy, and we will not share this information with any third parties. If you ever have any questions regarding the privacy of your data or any other matter related to our services, please do not hesitate to reach out to the Jestiyon support team.

How Does the Process Work If I Want to Cancel After Subscribing?

You have the flexibility to cancel your subscription at any time by following a simple process. Just navigate to the End My Subscription tab and proceed to complete the cancellation by paying the current month’s fee. This user-friendly approach ensures that you have full control over your subscription, allowing you to make changes or end your subscription as needed, in a hassle-free manner. If you encounter any difficulties or have questions during this process, don’t hesitate to contact the Jestiyon support team for guidance and assistance.

Are Your Packages Committed?

It’s important to note that none of our Jestiyon packages involve any contractual obligations. However, as a gesture of our appreciation and to facilitate your financial transactions, we offer the Jest Package at no cost when you commit to a 12-month subscription to individual packages. In the event you need to cancel your subscription within those 12 months, we kindly request that the package price be honored. It’s essential to keep in mind that if you decide to close your company, this fee will not be charged.

Company Formation

Abroad UK

Can I Incorporate and Manage My Company without the Need to Go to the UK?

Establishing a company in the UK has never been easier, thanks to the fully digital system in place. You don’t need to physically visit the UK; the entire process can be managed online. With Jestiyon, you can not only establish your company but also manage it entirely digitally from start to finish, eliminating the need for physical presence in the UK. Our platform streamlines the incorporation process and ensures that you can efficiently handle all necessary tasks online. If you ever need assistance during this process, Jestiyon support team is here to guide you and provide the support you require.

What are the Requirements for Company Formation in England?

To establish a company in the UK, you will need the following information:

- Company name

- Fields of activity

- Company managers and partners

- Share structure

- Passport and residence documents of the manager and partners, if applicable

- Your UK company address

For guidance, support, and assistance throughout the process of establishing your UK company, Jestiyon support is available to provide expert advice and ensure a smooth and efficient experience.

How long does it take to incorporate a company in England?

With Jestiyon, the process of establishing a company in the UK is remarkably swift and efficient. Once you’ve provided all the necessary information and documents, you can expect your company to be fully established within just 2 business days at the latest.

How to Open an Online Bank in England?

To open an online bank account in the UK for your company, you typically need to provide the following information:

- Company Number

- Company Name

- Company Address

These details are crucial for the bank’s verification process and ensuring compliance with banking regulations. It’s important to have these documents and information in order before applying for an online bank account for your UK-based company.

Is It Mandatory to Get Accounting Services for My Company in England?

In the UK, while there isn’t a mandatory requirement for businesses to utilize accounting services, it’s essential for companies to fulfill their financial responsibilities accurately and in compliance with tax regulations. Companies are obliged to declare their corporate tax at the end of the fiscal year, closely monitor their turnover throughout the year, and keep a watchful eye on their VAT exemption limit. If you are not well-versed in UK regulations or find it challenging to manage these financial aspects on your own, Jestiyon support team can help ensure that your financial statements and tax declarations are accurate.

How Can I Issue Invoices Through My Company in England?

When you establish a company in the UK, you have the capability to create and utilize invoice drafts that adhere to UK regulations. These invoices can be easily generated and sent to your customers as PDF documents. This approach aligns with modern business practices and ensures that your invoicing process is compliant with local regulations. Sending invoices in PDF format is not only convenient but also allows for efficient record-keeping and easy sharing with your customers, contributing to a streamlined and professional invoicing system for your UK-based business.

Company Formation

Abroad America

Can I Incorporate a Company in America without the Need to Go to America?

Establishing a company in the United States is facilitated by the online application procedures and regulatory framework. With Jestiyon, you can take full advantage of these digital processes and streamline the establishment of your US-based company. Moreover, you can benefit from the Registered Agent service, which is a mandatory requirement for the establishment of a US company. Jestiyon provides this essential service, ensuring that you fulfill this requirement without any hassle.

Which Documents are Required for Company Formation in America?

To establish a company in America, you’ll need the following:

- Company name

- Activity area

- Company managers and partners

- Passport and residence documents of the manager and partners, if applicable

Should you have any questions or require guidance during this process, Jestiyon support is here to assist you every step of the way, ensuring that your company establishment in the United States proceeds smoothly and efficiently.

How Many Days Does It Take to Establish a Company in America?

The timeline for establishing a company in the United States can vary based on the specific state you choose for incorporation. On average, the process typically takes around 4 to 8 business days with the Jestiyon support team. However, it’s important to be aware that delays can occur, particularly in states that experience higher demand at the beginning of the year or during the first 4 months of the year.

How to Open an Online Bank Account in America?

Opening an online bank account for your company in the United States is a convenient and essential step for many businesses. Typically, the requirements to open a business bank account in the United States include the following:

- Company Formation Documents

- EIN (Employer Identification Number

- Address Information

By having these documents ready, you can expedite the account opening process.

Can I Get a Visa by Establishing a Company in America?

Establishing a company in the United States can offer significant advantages for obtaining certain visas, such as the E1 and E2 visas. These visas are designed to promote international trade and investment. If your company has been in operation for at least one year, has completed the necessary tax period, and has a specific level of capital, it can provide a substantial advantage when applying for these visas.

Do I Need Accounting Services for My Company in America?

When you establish a company in the United States, your tax obligations begin, and you’ll need to file taxes between January and April the following year. If you’re unfamiliar with U.S. tax regulations, it’s advisable to seek accounting services before or during the tax declaration period. For guidance, you can rely on Jestiyon support to navigate the process accurately and efficiently.

How Can I Issue Invoices Through My Company in America?

Once you’ve established your company in the United States, you gain the capability to begin issuing invoices. This process is simplified as you can generate invoices in a format that adheres to American standards and easily send them to your customers as PDF documents.

Company

Establishment

Abroad Germany

What are the packages offered by Jestiyon for Vat Registration in Germany?

Jestiyon offers you the convenience of registering for VAT in Germany, even for your existing company. We provide specialized packages for registering VAT in Germany for both sole proprietorships and capital companies.

In our VAT registration package for your existing company, you’ll benefit from:

- VAT Registration

- Notary transactions

- Power of attorney

- Digital transmission of all VAT registration documents to you

Your VAT number will be established within a period of 21 to 28 business days after your VAT application is initiated as part of the package.

Do I Need an Accounting Service When I Get a VAT Number in Germany?

Obtaining a VAT number in Germany is a crucial step for doing business in the country and Europe. However, with this registration comes the responsibility of managing your sales, reporting, and compliance. Monthly reporting to the German Tax Office and submitting a final declaration every 3 months is mandatory. Additionally, in specific situations, if the German Tax Office conducts an audit, it’s vital to have your accountant in Germany present during the audit.

What are the Additional Services Jestiyon Offers You?

Jestiyon is dedicated to simplifying your business operations by offering a range of additional services. In addition to facilitating VAT and accounting services, we also provide an EORI number service, which enables you to seamlessly engage in importing and exporting activities. With our accounting service, your financial reports and declarations are expertly handled, ensuring a smooth and trouble-free experience in Germany.What are the Documents Required for VAT Registration in Germany?

When it comes to VAT registration in Germany, the German Tax Office requires specific information for your existing company. This typically includes:

- Tax Certificate

- Signature Circular / Signature Declaration

- Liability Letter

- Commercial Activity Documents

- Power of attorney

- EURO Bank account information and Swift Code

- A screenshot of your Amazon Account

What are the Benefits of the Packages Jestiyon Offers for VAT Registration in Germany?

Choosing Jestiyon for the process of establishing a company abroad not only shields you from the high costs and operational complexities of obtaining a VAT Number in Germany but also offers comprehensive packages that simplify the entire journey. These packages include services like the delivery of official documents, sparing you from dealing with separate costs and lengthy processes.

Furthermore, our packages are designed to boost your earnings in your international commercial activities. With the Jestiyon support team, your journey of establishing a company abroad becomes efficient, cost-effective, and profit-focused.

Company

Establishment

Abroad Estonia

What are the Packages Offered to Establish a Company in Estonia?

With Jestiyon, you have the opportunity to establish a company in Estonia using e-Residency, simplifying the process for you. This package includes:

- Establishing a company with e-Residency

- Private limited company

- A state fee of 265€

Our comprehensive package ensures that company establishment in Estonia can be completed within just 5 business days. If you need assistance or have any questions during this process, you can rely on Jestiyon support to provide guidance, making your experience both efficient.

Is E-Residency Required to Establish a Company in Estonia?

To establish a company in Estonia, it’s essential to hold an e-Residency ID. All the required procedures for setting up your company will be conducted using your e-Residency ID. Therefore, it’s imperative that you’ve completed your ID application and received your e-Residency card before commencing the company establishment process.

Does Having E-Residency Help with Visa and Residence Permit?

It’s important to note that having e-Residency on its own does not have a direct impact on obtaining citizenship, a residence permit, or a visa. E-Residency primarily enables you to establish a company and manage your business affairs online. However, the company you establish in conjunction with e-Residency can potentially open doors to certain visa types, depending on the specific regulations and agreements between countries. Visa applications related to your business endeavors can offer opportunities for international mobility, but they are typically separate from e-Residency and subject to their own eligibility criteria and requirements.

What are the Additional Services Jestiyon Offers You?

Jestiyon simplifies your business journey with essential services. This includes Estonian company address, online bank account setup, and taxation support. With Jestiyon, your financial operations become professional and secure. For international trade, we offer EORI number service. Jestiyon support is here to guide you, making your business experience efficient and profitable in Estonia.

Jestiyon’s Company in Estonia

Establishing your company in Estonia with Jestiyon is a streamlined process that offers a wealth of benefits. We provide comprehensive support, including the Jestiyon support team, to guide you every step of the way. Our services cover everything from e-Residency application support to VAT registration and beyond. With Jestiyon, you can have your Estonian company up and running quickly, typically within just five business days. We also offer additional services like EORI number registration and online bank account setup.