HMRC (HM Revenue & Customs) is the government agency responsible for tax collection and customs clearance in the UK. It collects taxes such as income tax, corporation tax, VAT, audits customs duties and manages other financial transactions. HMRC plays an important role in the financing of public services and the economic security of the country. You can learn about HM Revenue & Customs’ responsibilities, tax payment processes and much more in the rest of our blog.

İçindekiler

What are HMRC’s Responsibilities?

HMRC (HM Revenue & Customs) administers various taxes such as income tax, corporation tax, capital gains tax, inheritance tax and insurance premium tax, as well as stamp, land and petroleum income taxes. Environmental taxes include climate change and aggregates tax and landfill tax. HMRC’s duties include Value Added Tax (VAT), import VAT, customs duty and excise duties, as well as the collection of trade statistics and national insurance contributions.

HM Revenue & Customs also administers tax credits, child benefit, the enforcement of the minimum wage, the collection of student loan repayments and money laundering control. With these responsibilities, HM Revenue & Customs plays a pivotal role in funding the UK’s public services and ensuring the country’s economic security.

Which Taxes are HMRC Responsible for Collecting?

HMRC is responsible for collecting various taxes in the UK. These include:

- Income tax,

- Corporation tax,

- Capital Gains tax,

- Stamp duty,

- Value Added tax (VAT),

- Customs duty,

- Excise duty.

HM Revenue & Customs also collects environmental taxes and national insurance contributions.

VAT (Value Added Tax)

Value Added Tax (VAT) is an indirect tax on the sale of goods and services. HMRC is responsible for collecting VAT in the UK. Businesses collect VAT on the goods and services they sell and pay it periodically, according to HMRC VAT payment plan. VAT is calculated by deducting the VAT that businesses pay on the goods and services they buy. The general VAT rate is 20%, but reduced rates may apply to certain goods and services. VAT is an important source of government revenue and plays an important role in financing public services.

Income Tax

Income tax is a tax on the income earned by individuals. HMRC collects income tax in the UK. This tax covers various types of income, such as salaries, self-employment earnings, rental income and gains from investments. Income tax is calculated progressively on earnings above a certain income. Each individual has a personal tax exemption and income above this exemption is taxed. Income tax is critical for financing public services.

Corporation Tax

Corporation tax is a tax paid on the profits made by companies operating in the UK. HMRC is responsible for collecting this tax. Companies pay corporation tax at a set rate on their net profit at the end of the financial year. The tax rate is set by the government and may change from time to time. Corporate tax is one of the sources of government revenue and plays an important role in financing public expenditure. In addition, the fulfillment of tax obligations by companies contributes to maintaining a fair and competitive business environment.

Stamp Duty

Stamp duty, as one of the HMRC duties is a tax levied on the approval and execution of certain documents and transactions. HMRC is responsible for collecting stamp duty in the UK. This tax, which is particularly common during property transactions, is calculated on a set value and paid by the buyer. Stamp duty is applied at varying rates depending on the value of the property, and generally the higher the value of the property, the higher the tax rate. This tax is one of the government’s sources of revenue and plays an important role in financing public services.

Capital Gains Tax

Capital gains tax is a tax on gains from the sale of assets. HMRC is responsible for collecting capital gains tax in the UK. This tax applies to profits from the sale of assets such as real estate, shares and valuables. Gains above a certain annual exemption amount are taxed. The capital gains tax rate varies depending on the total income of individuals and businesses and the type of gain. This tax is one of the sources of government revenue and is used to finance public expenditures.

Customs Duty

Customs duty is a tax levied on goods imported into the country. HMRC is responsible for collecting customs duty in the UK. This tax is applied at varying rates depending on the type, value and origin of the imported goods. Customs duty is imposed to protect domestic producers, balance the balance of trade and contribute to government revenue. Customs duty is declared and paid during import transactions. Customs duty is part of the country’s economic and commercial policies and plays an important role in the regulation of international trade.

Excise Duties

Excise duties are indirect taxes levied on certain goods and services. HMRC is responsible for collecting excise duties in the UK. These taxes are usually levied on goods such as alcohol, tobacco products, fuel and luxury goods. Excise taxes can be imposed to limit the use of certain products, protect public health and reduce environmental impacts. They are also an important source of government revenue and are used to finance public services. Her Majesty’s Customs and Excise taxes also function as an instrument of economic and social policies.

How Do Companies Pay Their Taxes to HMRC?

Companies’ HMRC tax payment deadlines depend on their taxable profits. Companies with taxable profits of up to £1.5 million must pay Corporation Tax 9 months and 1 day after the end of their accounting period. This period is usually the same as the financial year, but there may be two accounting periods in the year of company incorporation. Companies with taxable profits of more than 1.5 million pounds must pay in installments.

Payment methods include online bank account authorization, online or telephone banking with Faster Payments or CHAPS, debit or corporate credit card payment. In addition, payment can be made within 3 working days with an already established direct debit and within 5 working days with a newly established direct debit. If the payment period falls on a weekend or public holiday, payment must be made on the last working day.

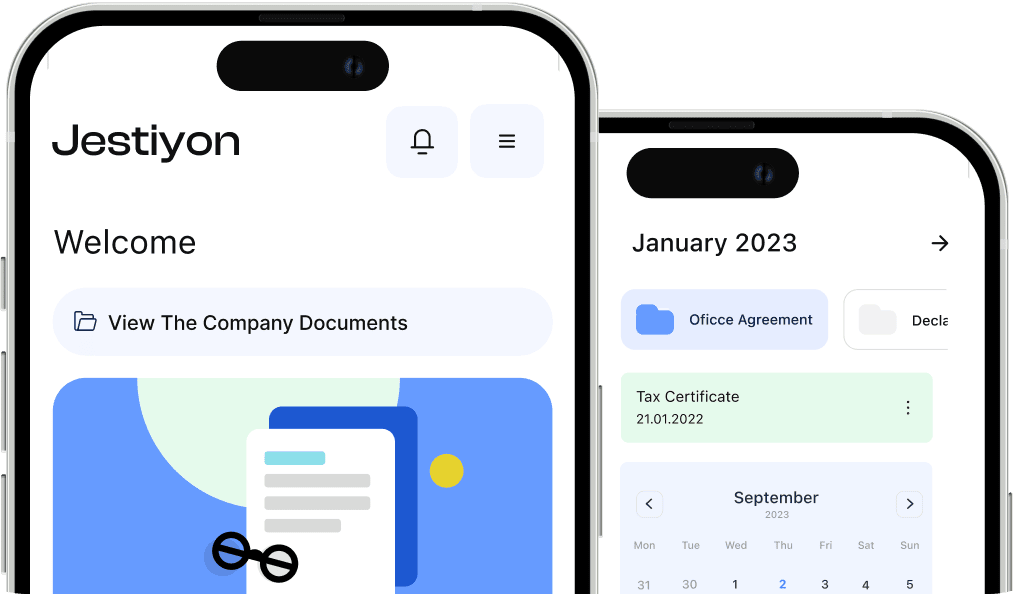

Manage Financial Processes Easily with Jestiyon

With Jestiyon, you can easily manage your financial processes abroad. At Jestiyon, which offers an effortless business management process, we provide you with professional services and give you the support you need in every service you prefer. While we quickly and accurately fulfill your HMRC tax refund requests in the UK, we also complete your HMRC tax returns in a complete and timely manner. With Jestiyon, you can easily manage complex financial processes and save time and cost in your tax transactions. We are with you every step of the way with our reliable services.