In the realm of business formation and operation, understanding the structure and essence of an LLC company is paramount for entrepreneurs aiming to navigate the corporate landscape with confidence and strategic acumen. An LLC, or Limited Liability Company, stands as a versatile business entity that blends the personal asset protection of a corporation with the tax efficiencies and operational flexibility of a partnership. To learn about the benefits of an LLC company in detail, you can continue to read our blog.

İçindekiler

Decoding Business Legalese: What Exactly is an LLC Company?

The LLC company definition outlines a business entity designed for entrepreneurs who prioritize flexibility alongside the protection of their personal assets. One can define LLC company as unlike sole proprietorships, the owners’ personal assets such as homes, cars, and savings are shielded from business-related lawsuits and debts. This feature is a cornerstone of the LLC’s appeal, providing a peace of mind that is invaluable in the uncertain world of business.

What are the Features of an LLC Company?

Beyond liability protection, the structure of an American LLC company offers unmatched flexibility in management and operations. Unlike corporations, which are bound by a fixed hierarchical structure and a board of directors, LLCs can be managed directly by their members or by designated managers. This flexibility allows LLCs to adapt quickly to changing business environments and member preferences.

The LLC company registration process further reflects this adaptability, offering a straightforward path to legal establishment without the cumbersome paperwork and formalities often associated with corporations. This streamlined process enables entrepreneurs to focus on growing their business rather than navigating bureaucratic hurdles.

Directing Your Business: How to Establish an LLC Company in the U.S.?

The journey to establish an LLC company in the U.S. begins with a crucial first step: selecting a distinctive name that complies with your state’s naming conventions. This name not only serves as your brand’s identity but also must be unique and not infringe on existing trademarks. Following this, the filing of LLC company documents, typically known as the Articles of Organization, with the state government formalizes your business’s legal existence. These documents outline the basic structure of your company, including its name, purpose, and the details of its members and managers.

Creating a comprehensive operating agreement is another pivotal step in this process. While not always legally required, this document is instrumental in defining the roles, responsibilities, and financial arrangements between members, thereby preventing future disputes.

Additionally, obtaining an Employer Identification Number (EIN) from the IRS is essential for tax purposes and enables your LLC to hire employees, open business bank accounts, and more. The guide to establishing a company in US on our website provides an in-depth look at these steps, ensuring entrepreneurs are well-equipped to navigate the establishment of an LLC.

What is the Cost of Establishing an LLC Company?

Embarking on the establishment of an LLC company entails a variety of costs, which can vary significantly across different states. The foundational expense is the state filing fee for the Articles of Organization, which can range from a modest sum to several hundred dollars. Legal fees for drafting an operating agreement or consulting with an attorney to ensure compliance with state laws can add to the initial outlay.

Additionally, potential costs for obtaining licenses and permits specific to your industry must be accounted for. Understanding these expenses is critical for budgeting accurately and setting your LLC up for a financially sound start.

Navigating the Tax Issues: How are LLC Companies Taxed in the U.S.?

The taxation of LLC companies showcases the entity’s inherent flexibility, offering multiple options that can suit various business strategies. By default, LLCs are treated as pass-through entities for tax purposes, meaning profits and losses pass directly to members who report this income on their personal tax returns. This structure avoids the double taxation faced by C corporations.

However, LLCs can also elect to be taxed as S corporations, which can be beneficial in reducing self-employment taxes on members’ income. The choice of LLC company taxes classification has profound implications for financial planning and operations, making consultation with a tax professional an essential step for LLC owners to maximize their tax benefits.

Limitless Possibilities: What are the Advantages of Establishing an LLC Company?

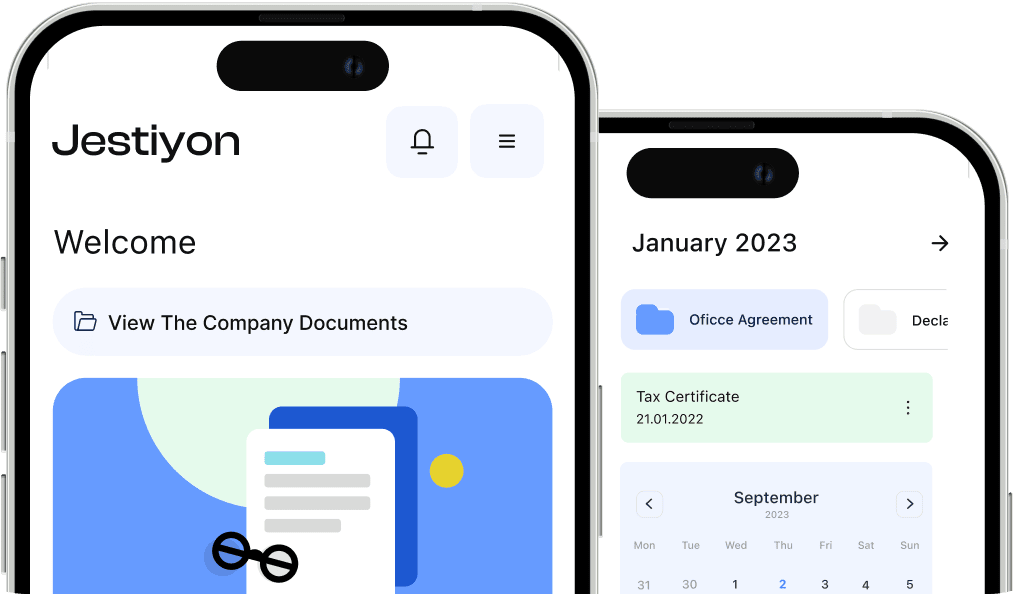

The advantages of an LLC company extend well beyond liability protection and tax flexibility. The operational ease of running an LLC, with fewer ongoing formalities and requirements compared to corporations, allows business owners to focus on strategic growth rather than administrative compliance. The credibility that comes with the LLC designation enhances a business’s stature in the eyes of customers, suppliers, and investors, opening up new avenues for growth and collaboration. Join us at Jestiyon, where we shape the future of your company.