The UK tax system is a complex framework comprising various levies designed to fund public spending and government services. Each tax serves a specific purpose within the system, from income tax to corporation tax, VAT, and council tax. Individuals and businesses navigate these obligations, adhering to tax laws administered by HM Revenue and Customs (HMRC) and other relevant authorities. Understanding these taxes is paramount for taxpayers to fulfill their obligations and contribute effectively to the functioning of the UK economy.

İçindekiler

What is the Tax System Like in the UK?

The taxing system in UK encompasses various levies that fund public spending. It primarily relies on income tax, national insurance, and value-added tax (VAT). Managed by HM Revenue and Customs (HMRC), Revenue Scotland, Welsh Revenue Authority, and Land & Property Services (Northern Ireland), taxes are collected throughout the fiscal year, which spans from 1st April to 31st March. Individuals adhere to a tax year from 6th April to 5th April.

Recent developments, such as adjustments to National Insurance and property tax rates, reflect ongoing changes in the UK tax system, aiming to balance revenue generation and economic considerations.

What Types of Taxes are There in the UK?

In the UK, various types of taxes contribute to public revenue and fund government expenditures. Key taxes include:

- Income tax levies earnings from employment, investments, and other sources.

- Corporation tax is imposed on profits generated by companies.

- Value-added tax (VAT) is applied to most goods and services.

- Council tax is charged on residential properties to fund local services.

Additionally, individuals may encounter other taxes such as capital gains, inheritance, and stamp duty land taxes. Understanding these taxes is crucial for individuals and businesses to effectively fulfill their tax obligations and navigate the UK tax system. Here are the main taxes that are important in the UK tax system:

Income Tax

UK income tax is a pivotal component of the UK tax system, applicable to various sources of income such as employment salary, business profits, pensions, and investments. Managed by HM Revenue and Customs (HMRC), residents pay income tax on international and UK earnings, while non-residents pay solely on their UK income. In the UK income tax system, the tax year, from 6th April to 5th April, governs individual tax obligations.

Pay As You Earn (PAYE) simplifies tax collection for most workers, deducting taxes from salaries. UK tax rates range from 0% to 45% in England, according to the UK tax system. Taxpayers must thoroughly understand the UK tax system, including the various UK tax brackets, to ensure accurate compliance with income tax regulations.

Corporation Tax

Corporation tax forms a crucial part of the UK tax system, targeting profits generated by companies and foreign entities with UK branches, clubs, and cooperatives. UK tax amounts levied on trading profits, investments, and chargeable gains.

HM Revenue and Customs (HMRC) administers corporation tax, with rates varying based on profits. The main rate stands at 25%, while businesses earning under £50,000 benefit from a reduced rate of 19%. Marginal relief applies to profits between £50,000 and £250,000, offering a sliding scale for taxation. Filing and payment are typically done annually, aligning with the company’s financial year.

VAT (Value Added Tax)

VAT constitutes a significant component of the UK tax system, applying to most goods and services. It operates on three rates: standard (20%), reduced (5%), and zero (0%). Businesses with a taxable turnover exceeding £85,000 must register for VAT, while those below can opt for voluntary registration.

VAT returns are submitted to HM Revenue and Customs (HMRC) every three months, detailing sales and purchases and owed or reclaimable VAT. Payment methods include Direct Debit or online channels. Compliance with VAT regulations is essential for businesses to avoid penalties and ensure financial integrity.

Council Tax

Council tax is a fundamental aspect of the UK tax system, financing local government services such as trash collection, emergency services, and road maintenance. Levied on residential properties, the amount varies based on property value and location, with each council setting different brackets.

Discounts or exemptions may apply for certain individuals, such as those living alone. Payment methods typically include online platforms or various physical outlets. Understanding council tax obligations is vital for residents to contribute to community services and adhere to local regulations.

What are the Tax Obligations of Companies in the UK?

In the UK, companies have several tax obligations governed by the UK tax system. These include corporation tax, payable on profits from trading activities, investments, and chargeable gains. Additionally, companies must adhere to VAT regulations if their taxable turnover exceeds £85,000, necessitating registration and regular filing of UK tax returns for VAT.

National Insurance contributions are mandatory for employees and deducted from their salaries. Compliance with these obligations is crucial for businesses to avoid penalties and maintain financial integrity. Furthermore, companies must stay abreast of tax laws and regulations changes to ensure accurate reporting and fulfillment of their tax liabilities.

Who is Exempt from Taxes in the UK?

In the UK tax system, certain individuals may be exempt from paying certain taxes based on specific criteria outlined in the tax laws. For example, some low-income earners may be eligible for tax exemptions or reductions. Additionally, certain types of income, such as certain welfare benefits or income from tax-exempt savings accounts like ISAs, may not be subject to income tax.

Charitable organizations and some non-profit entities may also qualify for tax exemptions on certain activities. However, tax exemption eligibility varies depending on individual circumstances and the type of tax in question.

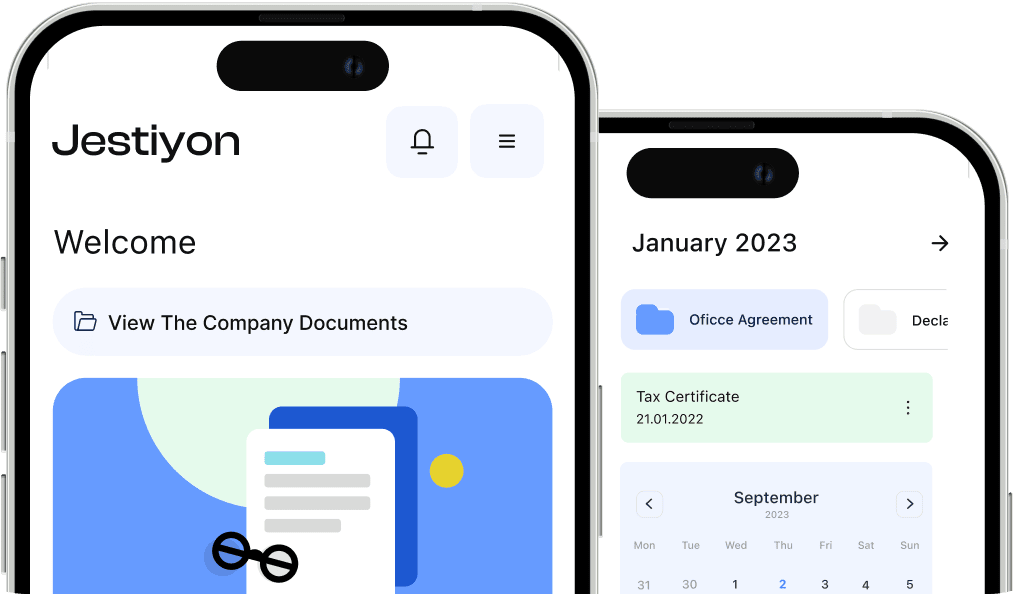

Manage Financial Processes Easily with Jestiyon

Jestiyon simplifies establishing and managing companies in the UK by offering tailored consultancy services. With advantageous packages and a solution-oriented approach, Jestiyon provides comprehensive guidance. Its innovative bookkeeping program simplifies financial tracking, enabling users to manage all aspects efficiently.

Additionally, Jestiyon facilitates obtaining a company address and EORI number, which is crucial for business operations. With Jestiyon, non-resident company owners can easily open an online bank account, which is essential for conducting transactions. Trust Jestiyon for effortless company establishment and financial management in the UK!