Opening a company operating in the UK is every entrepreneur’s dream with a global perspective. For the continuity of the company, it is necessary to master the country’s legislation. In this blog, you can learn the changes about the new UK VAT legislation that you need to know to run a successful company in the UK.

İçindekiler

What You Should Know About Company Formation in the United Kingdom

There are important points to consider when setting up a company in the UK. In addition to the legal procedures applicable at all times, under new regulations effective from 4 March 2024, companies must maintain an appropriate registered office address and a registered email address. When forming a company, you must also make a legal statement of purpose and verify that future activities will be legal. In addition, the scope of VAT has been much more detailed with the UK VAT legislation that came into force on 1 May.

HMRC New Legislation and Company Formation in the UK

New legislation published by HMRC on 1 May brings significant changes to the VAT registration requirements for companies that have a physical office in the UK but are not resident in the UK. Under current UK VAT legislation, there are various changes that those wishing to set up a company in the UK must consider. With the legislation on 1 May, some regulations have also been introduced to individuals or companies defined as Non-established Taxable Persons (NETP) who do not have a fixed place of business in the UK and are not registered for VAT.

VAT Registration Requirements and Exceptions

According to UK VAT registration rules, conditions are required when businesses supply taxable goods or services and exceed a certain turnover threshold. However, companies that are classed as a Non-established Taxable Person (NETP) and do not have a fixed place of business in the UK may also be required to register for VAT. NETPs’ UK VAT requirements depend on whether there are business activities in the UK and whether those activities fall within the scope of their business. Sometimes, small-value products or certain services may be exempt from VAT.

Non-Resident Taxpayer (NEPT) Persons

Individuals or businesses with non-established taxable persons (NETP) status fall into this category when they have no fixed place of business in the UK and do not meet VAT registration requirements. To be considered a NETP, the company must not have a location or permanent physical presence in the UK, where central management decisions are made. If these conditions are met, the business will retain its NETP status and may be subject to different VAT registration obligations. In this case, the company must register under Schedule 1 or Schedule 3A of the VAT Act according to the UK VAT legislation.

VAT Exemption for Products Under £135

VAT UK tax exemption may apply for items valued under £135 in the UK. This exemption is especially important for e-commerce activities. On imports of low-value products, VAT is collected by the supplier rather than the importer, simplifying the import process. However, suppliers must make accurate declarations, comply with UK VAT export rules and import requirements, and meet mandatory VAT obligations.

Staffing and Business Resources in the UK

According to UK VAT legislation, businesses employing staff in the UK must pay their employees’ taxes through the Pay As You Earn (PAYE) system. PAYE enables employees to have their income tax and national insurance contributions deducted from their wages and paid directly to HMRC, streamlining and simplifying businesses’ tax liabilities.

HMRC New Regulations for Selling on Amazon

HMRC’s new regulations significantly change UK VAT on e-commerce legislation for businesses selling on e-commerce platforms like Amazon. These regulations make VAT registration mandatory for companies if they exceed a certain turnover threshold. It also ensures that e-commerce platforms ensure sellers’ VAT compliance and that VAT is charged correctly. This aims to tax online sales in a more transparent and orderly way.

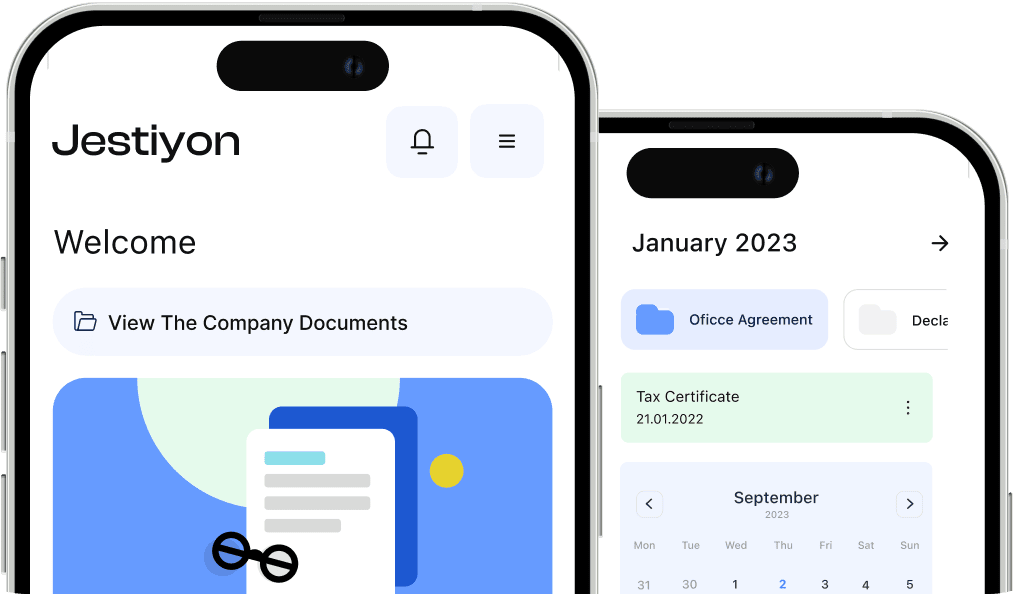

Create and Manage Your Company Easily with Jestiyon!

Jestiyon’s user-friendly platform simplifies the company formation process, quickly prepares necessary documents, and ensures legal compliance, including UK VAT legislation. It also provides tools that support the day-to-day management of your business, allowing you to run your business smoothly and effectively. You can choose Jestiyon for smooth workflows.