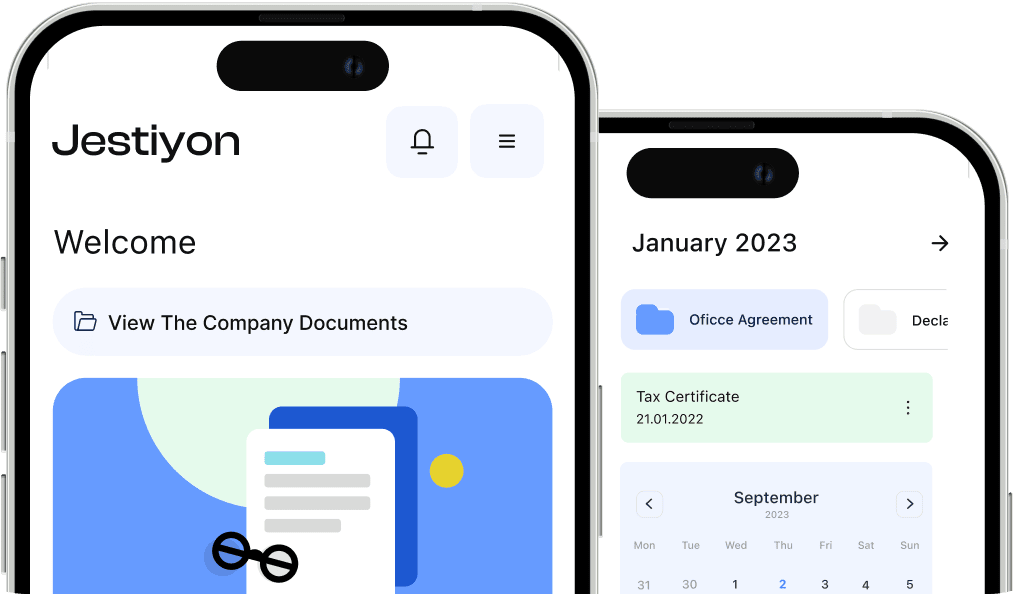

Set out to improve your company’s reputation by taking the advantages of a business bank account. Creating a dedicated business account streamlines financial procedures and promotes effective management while also communicating professionalism to partners and clients. These benefits, which range from easier tax administration to easier credit line access, offer a strong platform for expansion. Benefit from increased credibility and financial flexibility by taking advantage of a business bank account’s features. Set out on the road to prosperity with Jestiyon right now.

İçindekiler

Enhancing Your Business Image

It is impossible to overestimate the significance of building and preserving a solid, professional image in the corporate world. Often, this journey starts with fundamental actions that set the stage for success and credibility in the future. One of these critical steps is to open a business bank account. Choosing a specialized business account sends a powerful impression of professionalism and seriousness to clients, partners, and stakeholders in addition to helping to separate cash.

Apart from its symbolic significance, it functions as a fundamental element of efficient financial administration, establishing a standard for fiscal responsibility and organizational discipline. Businesses can streamline their financial processes and provide a dedicated and unambiguous channel for all business-related transactions by establishing this unique financial organization. This action not only helps the business appear more credible to outside parties, but it also clears the path for improved financial management and expansion.

Easy Management of Taxation

The key to easier tax management is unlocked for setting up a business bank account. This specialist account makes it simpler to identify deductible expenses and accurately report income by precisely defining company transactions. In addition to being essential for simple tax filing, this boundary is critical for reducing the legal risks related to financial reporting. Furthermore, a crucial component of effective financial management is compliance and preparedness for tax season, which is ensured by the capacity to monitor and classify transactions particularly connected to business activities.

Accessing a Reliable Line of Credit

Opening a bank account for business is not only taking a step toward better financial management but also toward a world of expanded financial options. It gets increasingly simpler to obtain corporate credit lines, which are an essential resource for expansion and sustainability. These credit facilities can play a crucial role in scaling up companies, including hiring more people, investing in new projects, and controlling operating costs when cash flow is tight. As a result, a company bank account opens doors to prospective expansion and financial agility.

Simplify Your Record Keeping

Opening a business bank account greatly simplifies the process of keeping accurate financial records. This phase presents a simplified method for recording transactions. The majority of company accounts have cutting-edge digital technologies built in for effective record-keeping. These solutions not only make accounting easier, but they also save a lot of time, which frees up resources that may be better used in other parts of the company. Such ease of record-keeping is very beneficial for both long-term financial planning and daily operations.

Tracking Incomes and Expenses

The advantages of a business bank account become clear when one realizes how important it is to keep a careful eye on all income and outlays in order to run a company’s finances. A business bank account makes this basic chore much easier with its features designed specifically for comprehensive financial supervision.

By employing these tools, companies can improve budgeting and financial planning accuracy and reliably acquire a thorough picture of their financial status. Maintaining financial stability and making educated business decisions depend on ongoing monitoring made possible by a business bank account’s benefits.

Specific Applications and Features for Business

Making the decision to open business bank account opens up a world of specialized features and apps, showcasing the advantages of a business bank account designed to satisfy specific business requirements. These features, which range from sophisticated security protocols to protect assets to customized financial services that meet particular business needs, ensure that firms can function with increased security and efficiency.

Businesses can further optimize their financial operations using the benefits of a business bank account by customizing their banking experience to match their industry thanks to the industry-specific functionality offered by many banks.

Separating Personal and Business Wealth

Recognizing the importance of opening a business bank account in keeping personal and corporate finances separate requires an understanding of how important it is to open one. This separation is essential to preserving individual financial security and obtaining clarity in business operations; it is much more than just an accounting suggestion. Entrepreneurs protect their personal assets from potential business liabilities by clearly separating personal cash from business transactions.

Choosing to register a company bank account is more than just following organizational procedures; it’s a calculated move toward creating a transparent and professional financial structure, which highlights one of the advantages of a business bank account. This choice establishes the foundation for a structured financial management system that builds partners’ and clients’ trust and confidence. The advantages of a business bank account enable business owners to make better informed decisions and plan for future expansion by providing them with a clearer and more accurate picture of their company’s financial situation.

Begin your journey toward enhanced financial management and credibility. Open a business bank account today and experience the benefits firsthand with Jestiyon.