The benefits of having a financial advisor for small businesses or big ones are multifaceted. These professionals provide invaluable insights, aiding in budgeting, financial planning, and risk management. With tailored advice, businesses can optimize their financial strategies, navigate challenges, and foster long-term stability and growth.

İçindekiler

Gaining Valuable Insights from Financial Professionals

Engaging with financial professionals offers unparalleled benefits for businesses seeking strategic growth. The benefits of business consulting services extend beyond conventional approaches, providing tailored solutions for sustainable success. Seasoned consultants adeptly navigate challenges, optimizing operations and fostering innovation. Meanwhile, the benefits of having financial consultancy are evident in informed decision-making and risk mitigation.

Financial professionals bring expertise to the table, offering valuable insights into fiscal health and future opportunities. Their strategic guidance not only ensures financial stability but positions companies for long-term prosperity. In essence, the dual advantages of business consulting services and financial consultancy synergize to drive optimal business performance and resilience.

Crafting a Customized Long-Term Strategy

Tailoring a customized long-term strategy is important for sustained business success. Leveraging the benefits of business consulting services provides companies with a strategic edge, offering expert guidance in navigating market complexities and seizing growth opportunities.

Additionally, the benefits of a financial advisor extend beyond conventional financial planning, contributing to the formulation of a strong, future-proof strategy. With their keen insights, financial advisors assist in optimizing resource allocation, managing risks, and ensuring fiscal resilience. Together, the combined advantages of business consulting services and a dedicated financial advisor empower businesses to craft resilient, adaptive strategies that stand the test of time.

Reducing Business Stress through Consultancy

Alleviating business stress becomes attainable through the transformative benefits of business consulting services and the advantages of having a financial advisor. Business consulting services act as a compass, guiding organizations through intricate challenges with tailored solutions. This not only streamlines operations but also enhances overall efficiency.

Simultaneously, the advantages of having a financial advisor extend to stress reduction by providing strategic financial planning. Advisors bring clarity to fiscal complexities, ensuring sound decisions that alleviate monetary concerns. Together, these indispensable services foster resilience, empowering businesses to navigate uncertainties with confidence and markedly reducing the stress associated with financial and operational intricacies.

Navigating Growth with Financial Consultancy

In the journey of business growth, the benefits of business consulting services and the invaluable role of a financial advisor for business are indispensable. Business consulting services act as catalysts for strategic expansion, offering tailored insights to overcome obstacles and seize opportunities. Simultaneously, the benefits of a financial advisor for business extend to prudent fiscal planning, ensuring sustainable growth and risk mitigation.

These professionals bring a nuanced understanding of financial landscapes, steering companies through the complexities of expansion. Together, the combined expertise of business consulting services and a dedicated financial advisor becomes a guiding force, propelling businesses toward growth with informed decisions and financial resilience.

Strategic Tax Optimization: Navigating Financial Success with Ease

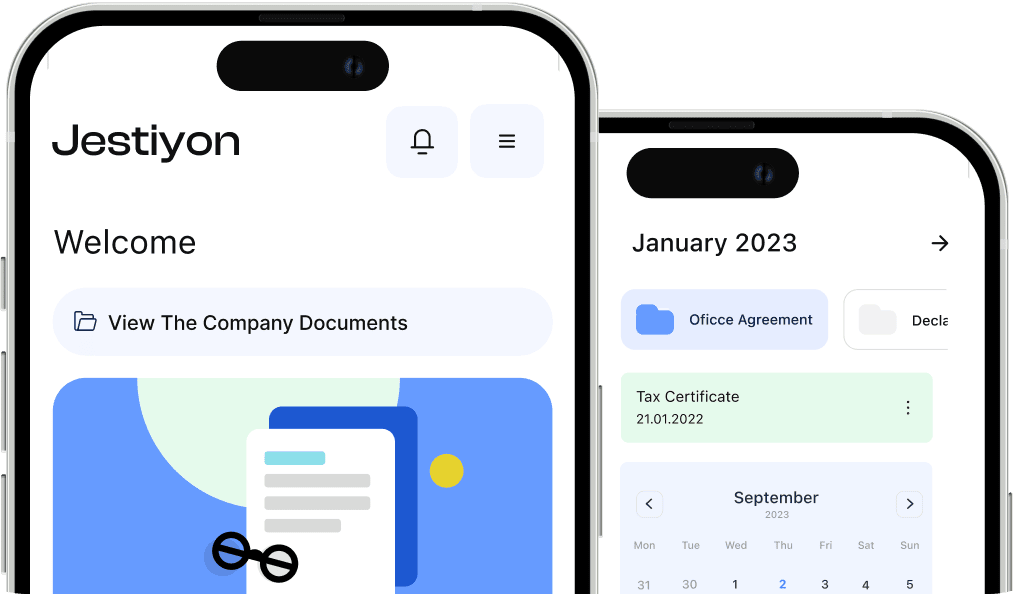

Tax optimization is a critical component of financial success. Having a financial advisor for business ensures tax laws and tax strategies to their advantage. This strategic approach to tax planning can result in significant savings, contributing positively to the bottom line. Jestiyon provides valuable guidance on various tax incentives, deductions, and credits that businesses may not be aware of, helping to minimize tax liabilities while maximizing financial health.

The benefits of having a financial advisor for business cannot be overstated. From crafting customized strategies to navigating growth and optimizing taxes, their role is central to the financial health and success of any business.

For those considering company formation in Turkey or looking to bolster their financial strategies, consulting with a financial professional is a step towards assured success. Experience the advantages of a financial advisor firsthand as Jestiyon propels your business to success, whether you operate locally or globally. Take the first step towards financial efficiency and growth – consult Jestiyon today.